Ever since the idea of tying travel to taxes started percolating in Washington years ago people with tax debt started seek good tax attorneys. Now that the IRS and the Justice Department have started cooperating it is even more cause for a tax debt resolution.

Now days anybody suffering tax debt that are out of the country can be arrested when they land on U.S. soil. Adding to the mix is FATCA, the Foreign Account Tax Compliance Act, which penalizes foreign banks that don’t hand over American account holders.

This is Actually going to become Law?

Now, the feds want to follow up on people even if they are reporting everything accurately, but have unpaid tax debts. Congress thinks America should do more to get the people on the move, or to prevent them from traveling to begin with. The reason is because, in certain states, state issued IDs do not comply with federal regulations. And unlike prior bills related to this topic that have stalled in Congress, this one is expected become law.

As if it were not enough to get your passport revoked, in case you are thinking that your passport is only for international flights, in 2016, some travelers might have to be prepared to use their passport on national flights..

Some states initially refused to comply with this initiative, fearing that the feds would make a national database of citizens. Others cited high administrative costs and a 50% increase in fees for travelers. Most states are OK, but millions in Louisiana, Minnesota, New Hampshire and New York may have to start using a passport to fly domestically.

Those states skipped the stricter standards for state-issued IDs. As a result, the TSA could insist on passports rather than driver’s licenses to board flights. The TSA will accept $55 passport cards and $135 passport books as valid identification. But some experts advise that people in Minnesota should get passports by January 2016 to fly domestically. New York has been granted a waiver, so any driver’s license should still work. Louisiana has a waiver until Oct. 10, 2016, meaning that existing driver’s licenses work there too. The same goes for for New Hampshire which has a waiver until June 1, 2016.

What Can I Do?

According to public opinion, the best approach may be to dig out your passport and contact your tax attorney to avoid any doubt, and even then the IRS may have something to say about whether your passport is any good or not. H.R.22 has passed both the House and the Senate already and it is expected to pass and be signed into law, adding new section 7345 to the tax code, the title of the section is “Revocation or Denial of Passport in Case of Certain Tax Delinquencies.”

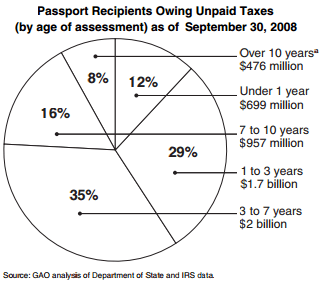

According to the Internal Revenue Service (IRS), as of the end of fiscal year 2010, the balance of reported unpaid federal taxes was about $330 billion, State issued passports to over 16 million people during fiscal year 2008; of these, over 224,000 of them (over 1 percent) owed over $5.8 billion in unpaid federal taxes as of September 30, 2008.

About 90 percent of the approximately $5.8 billion in unpaid taxes comprised individual income taxes. The other 10 percent of taxes were taxes owed from “trust fund recovery penalties.” In these situations, the IRS found that individuals within the business like corporate officers were personally liable for the payroll taxes withheld from employees’ paychecks but not forwarded and assessed a civil monetary penalty for those withheld amounts.

There is a 10-year statutory collection period beyond which IRS is prohibited from attempting to collect tax debt.

At the moment there are numerous tax attorneys who have confirmed that the 10-year time limit may be suspended and include periods during which the taxpayer is involved in a collection due process appeal, litigation, a pending offer in compromise, or an installment agreement. As a result, the figure shown above includes taxes that are for tax periods for over 10 years.

The figures cited here only represent passports issued for 1 fiscal year. As such, our estimate likely understates the total amount of unpaid taxes by all passport holders.

There are tens of millions of passport holders, thus the number of passport holders with unpaid federal taxes and the magnitude of unpaid federal taxes owed by passport holders are likely to be substantially higher than the figures cited in this report.

$50,000 will be the Threshold that the IRS uses

The IRS will create a list of affected taxpayers, they will also use a threshold of $50,000 of unpaid federal taxes, but this $50,000 figure includes penalties and interest, and as everyone knows, interest and penalties can add up fast. if you are contesting a proposed tax bill administratively with the IRS or in court, that should not count. That is not yet a tax debt, however you must keep in mind that not all cases are the same and we advise that you verify with your tax attorney first before making any decisions on how to proceed.

There is also an administrative exception, allowing the State Department to issue a passport in an emergency or for humanitarian reasons, with the help of a tax attorney this process should be much easier, but how that will work isn’t clear, nor is the amount of time it will take to get special dispensation. You would still be able to travel if your tax debt is being paid in a timely manner, as under a signed installment agreement.

Yet the dynamics are still significant and could drastically alter how people interact with the IRS, moreover, these rules are not limited to criminal tax cases, they are not even limited to situations where the government thinks that you are fleeing a tax debt. In fact, you could have your passport revoked just because you owe $50,000 or more and the IRS has filed a notice for a tax lien, so if you think that this could apply to you then we strongly advise that you inform your tax attorney at your earliest opportunity.

A $50,000 tax debt is easy to collect today, especially considering interest and penalties, moreover, the IRS files tax liens routinely. It’s the IRS way of putting creditors on notice so the IRS eventually gets paid, in that sense, the you-can’t-travel idea seems extreme, IRS tax liens cover all your property, even acquired after the lien is filed, the courts use liens to establish priority in bankruptcy proceedings and real estate sales, the IRS can file a Notice of Federal Tax Lien after:

IRS assesses the liability; IRS sends a Notice and Demand for Payment saying how much you owe, and if you fail to fully pay within 10 days, a tax lien can also be filed by mistakes In most cases, there is no mistake and the IRS lien is valid, but in some cases, the person might not actually owe the taxes and may just need to straighten out a pile of paperwork for which a tax attorney would come in very handy. Make sure you know your tax debt relief options before making any rash decisions.

Many people have already started debating whether this is constitutional or not since the right to travel has already been established, both statewide and internationally, and although some restrictions have been upheld, it is not clear that this measure would pass the constitutional test.

Consider especially the roughly eight million Americans living overseas, many of whom are already reeling from FATCA compliance problems, moreover, although we think of passports as useful only when traveling internationally, even stateside flights may soon make passports even more fundamental.

Is there anything I can do right now?

If you find yourself in a situation in which you need resolution for your tax relief options are:

- Agreement of reduced amount of payment in exchange for resolving tax liability (OIC)

- Opportunity for taxpayer to make a payment plan with the IRS (IA)

- First time noncompliant taxpayers can request a penalty reduction in connection with an installment agreement (PA)

- Taxpayer can also request a ‘currently non collectible’ request if they are experiencing extreme economic or personal hardship (CNC)

- An assessment can be requested for the taxpayer in which the IRS can extend their due date for repayment up to 10 years (CSED)

- The taxpayer can request a lien negotiation in which they use an asset to retrieve the money for repayment.

- A professional tax debt relief company or a tax attorney can also create custom solutions on your behalf pending your consultation.

Sources:

http://www.curadebt.com/tax-debt-relief/

https://www.irs.gov/Businesses/Corporations/Foreign-Account-Tax-Compliance-Act-FATCA

Recent Comments