One of the key questions that each mobile app founder would ask himself is “How do I monetize my app?”. This question is actually composed of two threads; first one being “Can I monetize it?” while the second – “Which business model should I choose?”.

During the 7th SemCon 2013 Conference in Manila I tried to shed light on calculating the Customer Lifetime Value, at the same time analyzing the most effective business model for apps, here referred to as “Freemium”. Easy Taxi, the biggest and more successful global app in the world, that I am affiliated with, constitutes a great case study on how Fremium works.

The company belongs to Rocket Internet, the global e-Commerce venture, present in multiple countries, and famous for its blitzkrieg-like execution. What distinguishes Rocket from other ventures capitalists is its unique style of management – represented by some of the most brilliant analysts in the world, thus making each new investment a complex number game. Analyzing the Customer Acquisition Cost (CAC) and Customer Lifestyle Value (cLTV) is an integral part of that process, which prevents unprofitable investments from taking place.

Business Model of Easy Taxi

The user can download Easy Taxi for free. The app is available on both iOS and Android devices, as well as Blackberry 10. The same app can be downloaded and used anywhere in the world, but the taxi network is available in 17 countries and 3 continents (and counting). Since both the operations and the product are fully “glocalized” (adapted to local markets), the company is able to change its business models whenever there is a need for that. The same refers to marketing.

There are two main groups of stakeholders – partner drivers and users. Drivers can become affiliated with Easy Taxi for free. Each of them is carefully interviewed, screened, and trained, while the company takes a copy of all the documents to increase the safety of the passengers. In case of the driver, both downloading and using the app is also free as such. So as the complimentary education, customer training programs, and various engagement campaigns. Drivers that do not have a phone are offered microfinanced rent-to-own contract, with weekly repayment of the smartphone value.

Where comes the financial exchange is the profit sharing. Since drivers receive more rides with Easy Taxi, the company charges the driver a small few for each completed ride. Those can be easily verified in the back-end system, which monitors the drivers and app usage. There are just a few countries, where the business model had to be changed so as to include additional booking fee for the passengers. This answers the second question, which is the user involvement in app monetization.

Philippines are one of those countries where app founders decided to introduce a booking fee. This is meant to solve a prevailing problem of a low income of taxi drivers, who would otherwise refuse boarding a passenger since a part of their income would have had to be shared. The model proved to work. 70 pesos on the top of the meter fee is not only affordable but usually goes hand in hand with the value of the tip that the passenger normally has to pay during the rush hours. Additional payment and incentive programs introduced by Easy Taxi motivate the driver and assure that the taxi will come to pick up the passenger. The ratio of the profit share varies per taxi fleet, since the company utilizes different modes of cooperation.

Thus, Easy Taxi business model is a freemium model in its purest. The majority of the apps these days use it. Looking at some of the world’s biggest apps – Viber, Facebook, SoundHound, Waze all use Fremium. Why did it become so popular? Because as a business owner you overcome some of the biggest obstacles in the user acquisition funnel, which is high cost of download. People tend to convert better if you give them a ‘sample’ of the product. In fact, this approach has been used for a long time. Taking a trip back in time, even in Medieval Arab merchants used to offer the buyers samples of their product to trigger the purchase.

Calculating the Customer Lifetime Value (cLTV)

Because of different business models, currencies, and app usage (or I should rather say loyalty), the lifetime value of the customer varies per country. In order to remain objective and make my case study easier to understand, the numbers I will use in the analysis below will all be expressed in pesos with different values per each purchase – the scenario more likely to occur for any product.

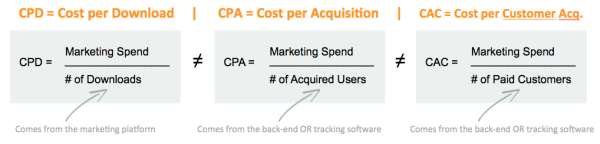

1. Customer Acquisition Cost is different to Cost per Download or Cost per User

Nothing to add, really. One must be cautious that any business-related analysis always has to refer to CAC, as oppose to CPD or CPA. That’s because not every single user who downloads your app will use it. But knowing the ratio of CPD/CAC is actually very useful.

2. The rule of thumb is that acquiring the customer (CAC) must cost less than what he gives back (cLTV)

This is quite logical and that’s the end point to any analysis. If acquiring the user costs more than the lifetime profits he returns, you better try to find a different way to monetize your app. This is a prevailing issue of startups in developed countries, where CAC can skyrocket up to a dozen of dollars.

3. Components of the cLTV analysis

Watch out ! This is pure mathematics and you are going to hate it. But it’s needed and let’s thus introduce the following variables to our analysis:

• Customer one-off expenditure (E) – How much did the customer spend during one purchase

• Number of purchases per month (P) – Self-explanatory

• AVG. Customer value per month (V) – This is from multiplying E x P and deriving with the average value

• Customer Lifespan (CL) – How long someone remains a customer. Let’s assume it’s 3 years

• Cust. Retention Rate (R) – Percentage of customers who repurchase. For our sample app: 30%

• Profit Margin (PM) – We will choose “20%” as the value

• The Rate of Discount (i) – Interest rate used in discounted cash flow analysis. For our app: 10%

• AVG. Gross Margin per Customer Lifespan (GM) – Profit margin x first calculated LTV. Please see below. For our app: 692.64

4. Calculations

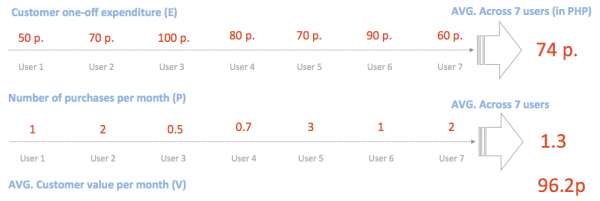

First let’s analyze the Avg. customer value per month based on our sample data. I included the following numbers, which helped me come up with an end value of 96.2 pesos.

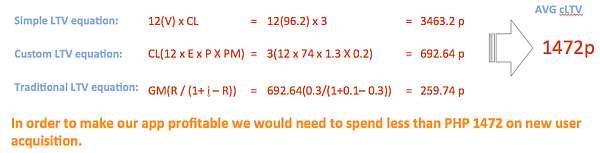

Once we know the value, the rest is all about using the variables we used in our assumptions. Since we want the calculations to be objective, the actual cLTV is modeled using 3 different methods. The final number is an average of all three.

You will fast notice that there are substantial differences between all 3 methods. That’s why averaging different cLTVs makes sense. Based on our calculations, the AVG cLTV amounted to 1472 pesos, which is the maximum value we would have to spend on each single new customer (not user) in order to keep our business profitable. Of course, the lower the CAC, the better – apart from the customer acquisition costs each business has certain overheads which also need to be covered by the profits collected through our apps.

There are two conclusions from my analysis, the first one is that Freemium is a prevailing business model, which proved to work and which you, as a future business owner, should choose for your app. The second is that you need to change the way you view your marketing and adapt all calculations to the main measures being Cost of Customer Acquisition (CAC) and Customer Lifetime Value (CLV). Only then you will be able to assure proper monetization and expansion of your, hopefully global, app.

Author: Paul Malicki

Recent Comments