When you are applying for a loan, out can seem like an impossible task. However, with several variables leading to an unsuccessful application, making sure that you are aware of these and working to ensure you are prepared will ensure your application is more likely to be accepted. In this article, we will be providing… Continue reading 5 Reasons Why You Might Get Rejected for A UK Loan

Category: Finance

Navigate the complexities of finance with our expert insights and tools. From budgeting tips to investment strategies, secure your financial future now!

Income Tax Terms Every Tax Payer Should Know

What are the most important terms when it comes to income tax? The tax deadline creeps upon you, and before you know it, you are flooded with terms and conditions you fail to make an iota of sense of. It’s important to know the ins and outs of filing your income taxes to lose money… Continue reading Income Tax Terms Every Tax Payer Should Know

A Financial Scam Victim? Take These Steps To Protect Your Rights

Unfortunately, more people than ever are realizing that they’ve been victims of a financial scam or crime. If you’re one of them, it’s essential to be aware of the steps you should take after discovering the fraud. While you may not be able to prevent yourself from falling victim to the scam, taking these steps… Continue reading A Financial Scam Victim? Take These Steps To Protect Your Rights

Gold IRA Comparison and How to Look for Legitimate Companies

Diversifying your portfolio may involve some investments in gold, real estate, small cap stocks, and more. With the diversification, you can better protect your wealth and reduce your risk at the same time. You may be interested in a retirement account with gold in it. Fortunately, one of the best methods to start investing in… Continue reading Gold IRA Comparison and How to Look for Legitimate Companies

The 3 Best Payment Methods for Your Employees

Currently, technology brings new payment options to help businesses grow. Employers have different choices concerning compensating their employees. The most widely recognized payment techniques include cash, check, and direct deposit. Every payment option has advantages and disadvantages and should be appropriately administered. Apart from simplifying payment options, Otto is the ideal company that provides cash… Continue reading The 3 Best Payment Methods for Your Employees

Finance Auditing: How It Can Make or Break Your Business?

Accounting is not simple maths and there is always a risk that there could be some intentional or unintentional discrepancies in your financial statements. Your financial statements tell the worth and financial position and performance of your business, therefore, it’s important that these discrepancies are detected and reconciled in your books of accounts. Although getting… Continue reading Finance Auditing: How It Can Make or Break Your Business?

What is GAP Insurance and How to Get Refund?

If you are a car owner or if you’ve leased a car, you must have some kind of insurance policy attached to it. In case you have an insurance policy attached to your car loan, depending on its type, it will provide compensation against damage or loss, but you might need to take an additional… Continue reading What is GAP Insurance and How to Get Refund?

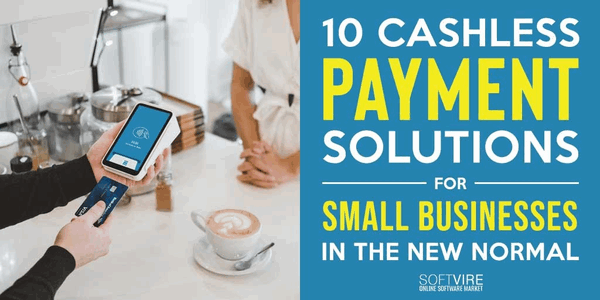

10 Cashless Payment Solutions for Small Businesses in the New Normal

Unlike large organizations and enterprises, small businesses rely on client payments to help them thrive. Payments are used to cover operating costs, staff pay, the purchase of new equipment, the replenishment of supplies, and other essentials required to keep the business going. Any payment delay can affect the business’s day-to-day operations, hence you need reliable business… Continue reading 10 Cashless Payment Solutions for Small Businesses in the New Normal

Where to Invest Now? 4 Useful Tips to Help You to Decide

Investing has its ups and downs like any other part of life you decide to be involved in. As a newbie, you may not even know where to start, which can leave you even more scared. But when you know where to invest your money, you’ll have some confidence. Today, there are a lot of… Continue reading Where to Invest Now? 4 Useful Tips to Help You to Decide

Writing a Financial Plan for Your Small Business: 6 Steps

Every business needs to be based on a business plan that covers the key aspects of its potential success. A business plan is supposed to guide you through the process of establishing and growing your small business, by using the facts and numbers you’ve gathered. And, the financial part of your business plan plays an… Continue reading Writing a Financial Plan for Your Small Business: 6 Steps

How Financial Regulations Work and Are They Any Good?

A well-functioning financial system must first be built for the economy, a firm, and its consumers to run efficiently. Fixed rules protecting you against risks and fraud are financial rules. The fundamental benchmark for principles and procedures regulating the setup, exercise, and supervision of the EU budget from the EU viewpoint is financial regulation. The… Continue reading How Financial Regulations Work and Are They Any Good?

How To Calculate Your Taxes As Someone Who Is Self-Employed: Find Out Here

Tax deductions can cause you huge losses, especially if you had tax arrears. As a taxpayer, employed or not, or when running your own business, could hurt your bottom line. There are itemized and standard deductions rates that will apply to everyone. Whatever you are making will be taxed by the government, which is good… Continue reading How To Calculate Your Taxes As Someone Who Is Self-Employed: Find Out Here