The GST has changed the way India does business and has tried to formalize the economy. One of the biggest issues with the pre-GST tax regime was the issue of double taxation.

Since the entire tax system was manually calculated and a lot of the transactions happened in the offline space, there was no way to check the value added to the production of goods every step of the way.

This led to a host of problems for the Government as well as businesses. Many taxes were piled on top of each other and there was no way to claim it back. The GST system has changed all of that. One of the biggest reasons the GST is an improvement over the previous tax regime is the introduction of the GSTN.

The GSTN or the Goods and Services Tax Network is the Information Technology infrastructure that underpins the entire GST system. The entire GST is online including filing, computing, and tracking of invoices.

This has allowed the Government to create a system of tax credits where each and every step of the journey of a product is tracked, thereby, limiting taxes on each step proportionate to the value being added.

This is calculated and any excess or double taxes paid by businesses can be claimed back using the Input Tax Credit under the GST system.

The main aspects of the Input Tax Credit are highlighted below :

1. What is Input Tax Credit:

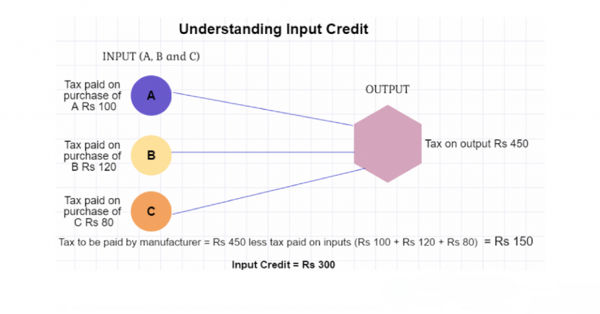

Input Tax Credit under the GST system is a way of paying the amount of taxes which are due in the proportion of value-added to a product every step of the way in the manufacturing process.

When a dealer purchases a product from a registered seller, they need to pay taxes to the seller. When the dealer then goes on to sell the product to the end-user, they get back some taxes from the consumer.

The final amount of taxes they need to pay the government is the amount of tax due for their services, i.e ( the tax on sales subtracted from the tax on purchases).

This way the business gets an Input Tax Credit and double taxation is avoided. All of this is facilitated by the GSTN Information Technology backbone by allowing all of the people involved in a transaction to upload their invoices and documents on the GST portal to facilitate tracking and compliance.

2. People Eligible To Claim Input Tax Credit:

The input tax credit is a great solution to the double taxation problem and a lot of people want to take advantage of it. There are a few rules and regulations with respect to eligibility. The Input Tax Credit can only be utilized by a taxable person registered under GST and they can show that they are able to fulfill all of the criteria below:

- The dealer needs to have a tax invoice.

- The described goods or services have been received.

- The taxes mentioned has been settled with the Government by the supplier.

- The Returns have been filed.

- If the supply of goods has been made in installments, the last installment needs to be completed before Input Tax Credit can be claimed.

- Dealers who are registered under the Composition Scheme are not eligible for ITC.

3. Procedure For Claiming Input Tax Credit:

One important aspect of the Input Tax Credit is that the tax credit is only available to businesses for goods and services utilized purely for the purposes of business operations. Items used for personal use or goods which are exempt from the GST altogether are not eligible for any Input Tax Credit.

Regular taxable persons must report the amount of Input Tax Credit on their monthly returns on their Form GSTR-3B. The GSTR Form -2A shows the amount of ITC reported by suppliers. Provisionally, a dealer can only claim 20% of the ITC shown in the Form GSTR-2A.

The Input Tax Credit claimed by a registered person has to be consistent with the information supplied by the supplier in the GST return. If there are any problems, the supplier and recipient will be notified of the issues and they need to be reconciled.

Conclusion:

There are a lot of issues which need to be kept in mind when the matter of Input Tax Credit is being discussed, the GST is a dynamic tax system which undergoes changes in response to market conditions and people need to check regularly any updates which are being rolled out from time to time.

The above-mentioned points is just part of a broad overview of what the Input Tax Credit system is all about. There are various other rules which state how to deal with specific GST issues which a business might have to deal with. The GST portal on the GSTN has a comprehensive FAQ section to help people learn more about the GST system.