By looking at the increasing graph of identity theft, businesses now require a more authentic method to verify their customers. Biometrics is the most widely applied verification process by companies. It is the process of verifying consumers based on their physical characters. Biometrics can be done on the basis of identifying the faces, eyes, hands, and palms of consumers.

The advancement in technology is causing a constant evolution in methods of biometrics as well. By starting from fingerprinting to iris recognition, enterprises now prefer facial recognition technology to verify their clients. It is the rapidly adopting biometric method nowadays. Because of increasing threats, most workplaces also have a facial biometric method to allow only authorized individuals to enter their place.

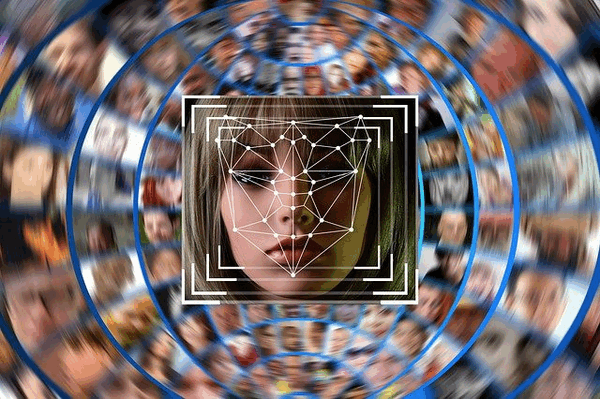

Facial Recognition Technology

Facial recognition technology is a method of biometric verification in which individuals are verified based on their facial features. Distance between eyes, nose, length of the jawline are all identified in facial recognition.

Being an online user who does not know the term password. Users for security reasons used to have passwords to access their confidential data. Along with passwords, another measure employed by vendors was the use of secret questions. All these security checks were utilized when the internet was a new thing. But with time, as more sophisticated ways of technology were introduced, identification processes have also become efficient with minimizing thefts.

Facial recognition has expanded in its popularity when electronic devices came with inbuilt cameras. With easy access to mobile phones, selfies have become the cool thing of this age. Users now prefer to unlock their devices with face recognition. It is also convenient for customers to show their faces to the camera instead of remembering long passwords.

What if a potential fraudster can easily access the representation of a customer’s face? Can we still call face verification a secure process? The answer is yes. Facial recognition reads the face of the individual in detail. Distance between the eyes, nose, and chin are recorded. The length of the jawline is also checked. With the help of 3D depth analysis and liveness detection, the deep corners of the face are registered

Levels of Facial Recognition Technology

There can be two alternatives for a facial program depending on the time it is performed:

- When the customers come for the first time, the software records their faces at the time of registration. The face of the individual is stored as an identity.

- Authentication can be performed when the image from the camera is matched against the face stored in the database. After successfully verifying the individual, the user will be given access to credentials associated with their name.

Use Cases Of Facial Recognition Program

The process of verifying customers based on their faces is used by Know Your Business according to their needs. Following are some use cases of it:

1. Customer Onboarding

The best way to ignore online fraud is by onboarding legitimate customers. Every business sustaining in this age is utilizing verification processes at the time of customer onboarding. Different enterprises prefer different methods, but the most sophisticated way available now is verification through facial recognition. Websites in the initial stages, ask the customer to upload any government-issued ID document that can be an ID card, driving license, and passport. Later the businesses take the user to a page that requires the customer to take their selfie and submit the image. The user takes the selfie and uploads the image. The software then matches the image on the ID document against the selfie uploaded by the client in real-time. The results are then delivered to the customer.

2. Multi-Factor Authentication

Some industries are highly vulnerable to online fraud. Banking and the financial sector topped the list. Fraudsters keep online transactions on the head of the list to commit crimes. Therefore, securing transactions of customers with the help of efficient technologies is the primary responsibility of businesses. Banks now have added the facial recognition program in their multifactor authentication system to ensure that authorized customers are making the transaction. This multifactor authentication is enhancing the customers’ trust in the enterprises as well.

Conclusion

The process of verifying individuals based on their facial features is utilized by various industries with banks and law enforcement on the top of the list. Facial recognition technology is utilized at various levels including customer onboarding and multifactor authentication to make the process more secure.