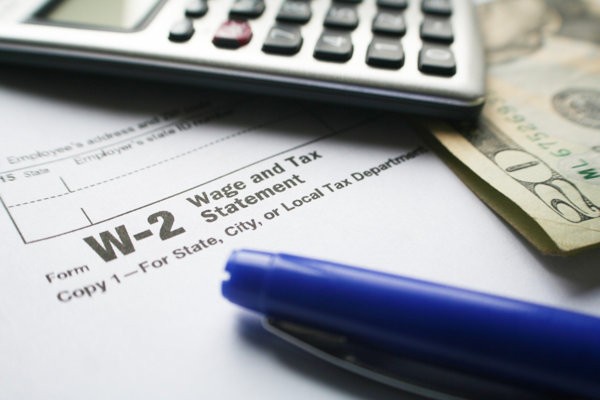

Tax season is around the corner and W2 forms will be distributed any day now. For many Americans, this is an exciting time of year. They are preparing to file their taxes in hopes of receiving a refund from Uncle Sam.

Last year, nearly 96 million Americans received a tax refund. The average refund amount was over $2700. After the holidays, you can imagine how important this money is to working-class families.

Read on for a comprehensive guide on how to file W2 forms. Explore important topics such as how to use W2 forms and what information they contain.

What Is a W2 Form?

Employers are required to complete a W2 form to notify the Internal Revenue Service (IRS) of an employee’s annual earnings. This form is required for all employees earning more than $600 in a calendar year.

At a top-level, the W2 form collects all information from employees’ paystubs throughout the year. This includes payroll deductions, withholdings, and benefits data. Online resources like www.paystubs.net are used by employers to report this information on a weekly or biweekly basis.

What Are the W2 Filing Requirements?

The easiest way to file a W2 is electronically on the Social Security Administration’s (SSA) website. As an employer, you will need to register to use SSA’s Business Services Online. This is the SSA’s mechanism for verifying your employees’ credentials and social security number.

You will also need to meet the government’s W2 filing deadline. The forms must be submitted to the SSA by January 31st each year.

It is important to note that you cannot submit Copy A of the W2 form that is downloadable from the IRS website. This copy is for informational purposes only.

Your company can be penalized or fined for filing Copy A. The reason that the IRS frowns on this is because Copy A cannot be scanned.

What Information Is on the W2 Form?

Now that we have covered filing requirements, it is time to move on to the pertinent data on the W2. Of course, the most important information is the total wages, tips, and compensation earned over the calendar year.

Also important is the amount of federal income tax withheld. In addition, the W2 shows wages that are withheld for government entitlement programs. These programs include Medicare and Social Security.

Some of the employee’s personal information is collected such as their address. The social security number is requested at the top of the form for identity verification.

Along the bottom of the W2 is the information required for the employee to file state income taxes. The bottom row shows the employee’s state ID number, wages, and income tax withheld. Because payroll deductions are calculated differently, state and federal wage amounts often do not match.

A Recap of How to File W2 Forms

For your employees, tax return seasons starts with receipt of the W2 form. It is not difficult to complete these IRS forms, but you must take care to follow government guidelines.

If you enjoyed this article about how to file W2 forms, check out our blog for more great content.

Recent Comments