Responsibility is not the only word, but it also has a significant and profound term that has a massive meaning. An obligation is a state where a person must cope with and are liable enough to finish the given task. Nonetheless, when the specified chore does not meet, there will be a fit of consequences.

As people grow older, there will be more and more tasks at hand. Adults require to apply for work to have an income considering there will be tons of accountability that involves money. Since all products, services, and owning a property’s value is equivalent to tens, hundreds to millions of dollars – which individuals have always been dreaming of retaining.

Unfortunately, some folks cannot afford to purchase a few of these artifacts and edifices. That is why in 2,000 BC, banks existed to give grain loans to farmers and traders who carried goods towards cities. In no time, these financial firms improved their credit to currency. The public market is gaining benefits as they give loans to start a business, purchase mobile phones and other paraphernalia, and buy their own home or vehicle. Additionally, as the global economy develops, so does the credit that banks offer to consumers.

In 1946, a Brooklyn banker named John Biggins implemented bank-issued charge cards. These bank cards are also known as Charg-It cards, where purchases straight forward to the Biggins’ bank. That is, the middleman compensates the trader and receives payment from the consumer. Soon enough, these Charg-It cards are now credit cards.

Credit cards are somewhat similar to Charg-it. It is a thin rectangular portion of plastic or metal released by the financial firm. The benefits that an individual will be getting from owning a credit card is multifarious. Possessing one will allow folk to build credit, earn rewards, cash backs, and miles points. They will protect against credit card fraud, free credit score information, no foreign transaction fees, and increased purchasing power, and one does not need to worry about it linking to a checking or savings account.

Ownership is a responsibility. Once a person holds control of something, they are accountable enough for whatever happens to it. It is the same with owning a credit card. It may not be a living thing, but the material within manifests importance to people – and that is money.

Money is an evil thing, considering it has the potency to influence folk into doing dreadful things. One of those is getting out of hand into spending. When this happens, it will lead to bankruptcy, losing all one’s belongings, and becoming in-debt. It is challenging to retain opulence when such inconvenience occurs.

Thus, it is significant for a person to know their responsibility and the repercussions when there are no liabilities done.

This fact is the very reason why credit cards are difficult to obtain. Most banks that ever existed only issue those who have a good and clean credit history. Not because they are hypocrites, but because they are saving other people from drowning in the distress of money.

In 2020, a plague from Wuhan, China, suddenly took the whole world by its toll. Within a few months, there are already hundred thousand to millions of casualties that was acquired globally. This pandemic resulted in the authorities implementing a mass lockdown that also left fatalities in the global economy. These mishaps caused many from suffering financial losses.

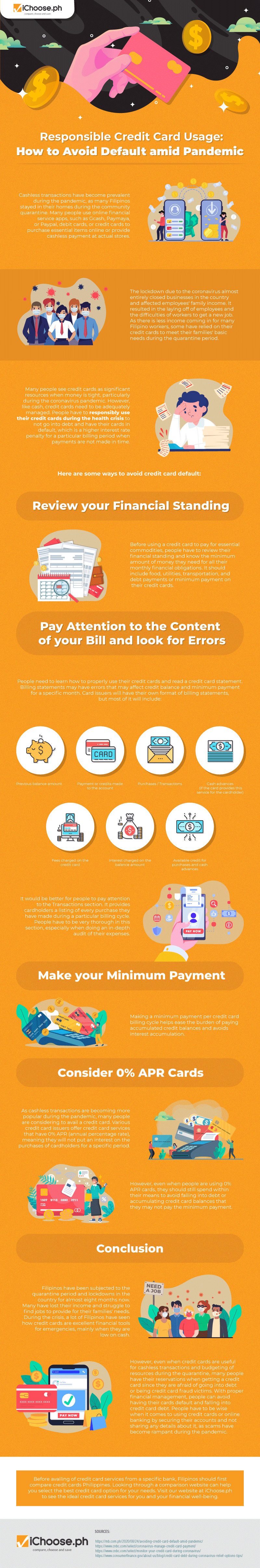

For this reason, iChoose.ph the most recognizable surety bond provider PH and offers credit card application online PH companies, created and designed an infographic regarding the responsible credit card usage and how to avoid default amid pandemic:

Recent Comments