Are you worried about your finances? Do you regularly seek out help from financial experts?

If yes, you aren’t alone. There exists a cohort with the same concern. And the reason- increasing economic uncertainties eating up the savings of the salaried population. It is a growing phenomenon not only in developing countries but also in developed countries.

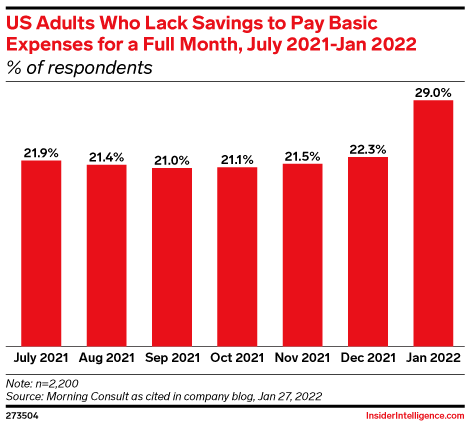

Please find the below graph to gain insights on the same:

You could see in this graph that as of Jan 2022 in USA almost 29% of respondents lacked savings to pay basic expenses for a full month. And the percentage has steadily increased from July 2021 with 21.9% of respondents, further with a slight decrease in August 2021 and September 2021. It then gradually increases to 21.1%, 21.5%, 22.3% in October, November, December 2021 respectively. Finally, it shot to 29% in the first month of 2022. Well now the question arises, could it have been reduced?

And the answer is- to a great extent with the right financial planning. If you’re determined to save every month to generate the desired savings, then no matter what you’ll do it. You’d cut down the unnecessary expenditure. This way you’d never be short of reserves when needed.

As per a quote by Venita VanCaspel, registered investment advisor:

“Financial planning is like navigation. If you know where you are and where you want to go, navigation isn’t such a great problem. It’s when you don’t know the two points that it’s difficult.”

A reality check is necessary for every salaried individual. You know that the job market is highly competitive. In the current scenario with global companies everywhere, you have to contend with professionals from different countries. This increases the stress level and also financial insecurity. Won’t financial planning ease the burden? You could plan- how many years you want to work, whether you want to open your start-up, have a stress-free job with a reasonable income, save for retirement, and so on. This is possible, if you have a real-time plan on your finances.

Why Do You Need Financial Planning?

While everyone needs financial security, you need to understand the objective of your financial planning. Whether you want to save money for education, buying a house, car, retirement or just saving for the future. This would give you an idea of strategizing and saving the right amount at a specific period.

The other aspect is if you have to repay the loan, financial planning is highly essential. It would relieve you from the burden of being a defaulter.

How Could You Achieve Financial Goals?

You could easily achieve these goals with the right strategy such as:

1 Investing Rightly:

Have ample knowledge of the stock market, bonds, mutual funds, gold and other types of securities and derivatives. Then you could invest rightly to get better returns. Don’t ever put all hopes on a single investment; plan where you’re going to invest and go ahead with your decision.

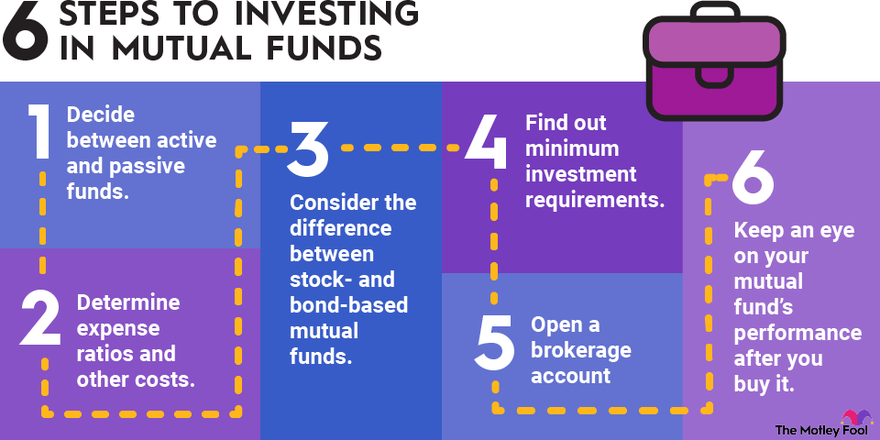

And if you’re looking to invest in mutual funds, find the entire process in the below image:

As you could see in this representation, there are 6 steps to investing in mutual funds. The first step involves deciding between active and passive funds. As per your requirements, you could decide. The first type has higher expense ratios while the latter has lower expense ratios. Now most investors are tempted to go for the passive fund due to lower expense ratios but remember you need to also check the disadvantages. Due to the non-involvement of the fund manager (they have good knowledge and experience in this area) in the passive funds, you might tend to lose out on some good money-making schemes. Just as they say,” no pain no gain”, in this scenario no huge expenditure, no huge ROI.

In later steps, you need to see the difference between stock and bond based mutual funds. You need to check the minimum requirements for investment and then open a brokerage account. But the process doesn’t end here, you have to keep a tab on the performance of funds. The return on investment is ensured with the execution of all the steps. Some of the hindrances that you need to be aware of are inflation, market risks which could drastically affect your return on investment.

2. Crystal Clear About Wants:

Be confident about your requirements (wants and needs) to make the right financial decision. This is what the youth of the country need to understand. They need to distinguish between their primary needs and secondary wants. As per a McKinsey report, about 40% of adults (18-23 years) stated that social media has highly motivated them to buy specific products.

Source: www.thezebra.com

And it’s no secret they are mostly expensive products or services. As a matter of fact, youth who are now adults (above 18 years) don’t know when to stop buying luxury products. They should do that for better financial security in future.

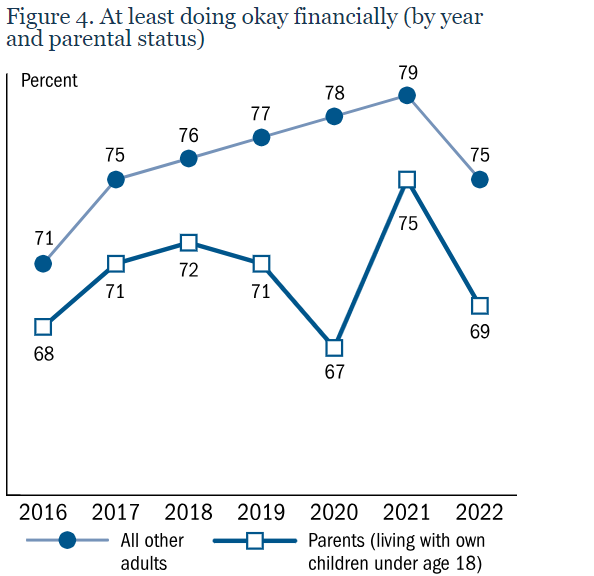

We would refer to another statistical representation shown below:

In this statistical representation, we see parents (living with their own children under age 18) who are doing okay financially drastically reduced from 75% to 69% from the year 2021 to 2022. While all other adults who are doing okay financially also reduced from 78% to 75%. It shows that employment opportunities aren’t that great. The majority of the population has their basic necessities fulfilled but can’t save much for their future. This isn’t good news as when you go on sabbatical leave or suddenly lose your job, there would be financial challenges. And if you don’t have a good credit score, you’d also not get loans, which again is a process where professionals check your entire history along with data mismatch and others.

But if you act smartly in the beginning, you’ll emerge as a winner.

3. Rationality to Understand Uncontrollable Factors:

Until you’re realistic about execution and how various factors (inflation, political environment and others) could affect your financial planning, you’ll reach nowhere at the planned period.

As the cost of living rises, you might face challenges in clearing the debts or loans at a specific time. And there are also over expectations which some people do have. For example, when you start hiking, you’d think you would cover much altitude in a day. And that isn’t possible, along with willpower you should have the support of the body that needs to be acclimatized.

So, exclude the financial practices that you rationally think aren’t feasible for you. Just putting them on paper which you aren’t going to implement would only overburden you.

Let’s take an example of how various factors could hamper financial planning.

An example of Neil,

Requirement: He needs to save money so that he can retire early and travel the world.

Savings: He plans to save $20 million by the age of 30

Period: He has 6 years to reach that target

Feasibility: Due to various factors such as wars affecting oil prices and cost of living, he has to review at a specific period and make changes in planning

Does early retirement planning matter? It’s a personal choice; Neil has chosen what best suits him. Traveling is enjoyable when you are stress-free. And early retirement for that seems good when planned appropriately.

Benefits of Financial Planning

- Rescue in Bad Times:

Life is a roller-coaster ride. You never know, when an emergency arises and you’re in dire need of a big sum. In such cases, savings could help you out. One of the best examples is mass firing in software companies leads to unemployment. Many individuals who don’t have decent savings in such scenarios could face challenges until they get a new job.

When you have a healthy bank account you could stay afloat for some months and pay your bills on time.

- Spending Rightly:

Some individuals spend a huge part of their salary on expensive items. It could be peer pressure or the glamorous lifestyle projected on social media. It could overburden their financial resources.

With precise financial planning, they’d have an idea of when they need to spend on a product and when not. It would save them from financial burden.

- A Balanced Lifestyle:

We shouldn’t be extravagant and enjoy life concurrently. This is possible with financial planning, where you could have the best education, house and even affordable vacation. You could also avail loan if necessary and not face challenges with this planning.

For a healthy mind, body and soul, you should work hard, and play hard. And yes, have a healthy lifestyle to avoid sedentary diseases.

Wrap Up

Financial planning is the need of the hour. If you want peace of mind, you should never shy away from it. Here, you could explore varied ideas; not every process or planning would suit your goals but you could choose the best aligned with your future plan.

Integrate the right idea and enjoy your life sans worries.

Author Bio: With useful Finance expertise, Dimple Digital is the head of the marketing department at Kenstone Capital Her visionary leadership has facilitated many organizations to increase sales and revenue.

Recent Comments