Not everyone is skilled at saving and budgeting finances. Taking the initiative to learn how to spend less, save more, and stick to a realistic budget plan can help you straighten out your finances, manage debt, prioritize expenses, and reach your short- and long-term financial goals.

Why is Saving Important?

Money doesn’t grow on trees, and unless you’re insanely wealthy, you will need to plan around significant expenses and goals in your life for you to afford them. Moreover, building a savings fund can come in handy on rainy days or unexpected expenses.

Being financially responsible means having the ability to pay for your bills on time, spend for yourself, and have a safety net and savings for the future. Having enough money that you can access anytime you need it can save you from debt and stress.

The best thing is if no emergency would require you to touch the fund, you could reallocate a portion of it to your retirement fund or education fund for your children. Below are some simple ways you can do to fix bad money habits and to start building a savings fund.

- Track your spending – Take note of every penny that goes in and out of your bank account. You’ll see how small expenses like your daily cup of coffee can add up. Being aware of how much you spend on unnecessary things will give you an idea about where you can cut costs and reallocate funds to your savings. Use a budget tracking app for a stress-free budgeting system.

- Resist the urge for impulse shopping – Dropping by malls or checking out deals and discounts online can put a dent in your wallet or bank account. Before you shop online or in physical stores, always ask yourself if you actually need it. If not, give your finances a rest.

- Avoid debt – Make sure to pay off your credit cards in full each month to keep the interest rate, late fees, and debt from piling up. The best way you can refrain yourself from falling into a credit card debt cycle is to avoid using your card and spend within your limits.

- Be frugal – Being frugal doesn’t necessarily mean that you have to be cheap. It’s to be value-oriented and more mindful of your shopping habits to get your money’s worth. For instance, it would save you more in the long run when you buy a quality product that can last you several years rather than a cheap alternative that wears out for a year or two.

- Set a spending limit on entertainment – Too much dining out, watching movies in cinemas, and after-work hangouts are bad for your finances, and can only cause financial stress when you find yourself living paycheck to paycheck.

Like with other major goals, reaching your savings goals will take some time. Consistency and commitment play key roles in helping you save money. Of course, you would also need some budgeting and financial planning to make hitting your target savings amount easier.

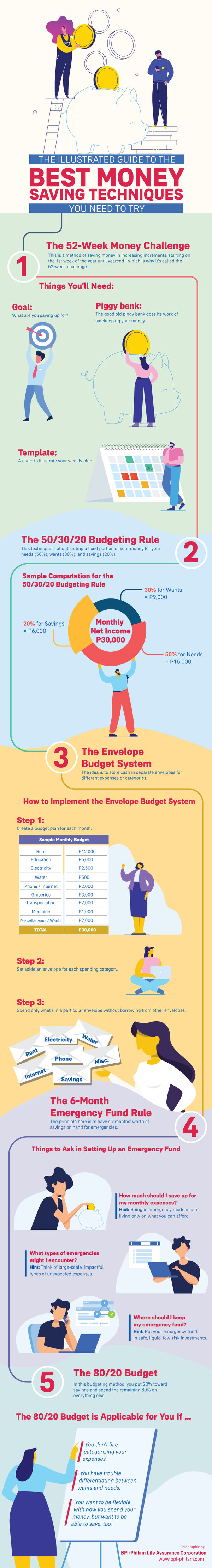

Let’s have a look at the visual illustration below for some budgeting techniques that can help you hit your savings goals in no time.

Recent Comments