Are you considering a business exit strategy? Perhaps your thoughts have already turned to a stress-free, work-free future; one that provides security for you and your family. Maybe you’re longing for more time in the sun or to indulge in the finer things in life? After working hard to build a successful business, you’ve more than earned it! If you’re thinking this way, there are plenty of business exit strategy options to consider. But before those dreams can become a reality, some serious thought must be given to the best choice for your own needs.

Your ideal business exit strategy will depend on many things. For example, how quickly you’d like to exit the business and if you wish to get full market value. Some owners may want a regular income but are unsure if that’s possible without continued daily involvement. When it comes to exiting their business, many owners also consider factors such as employee stability and preserving the company name. They might also wish to secure a legacy within the business community.

Give yourself time to plan if you can…

Generally speaking, if you have more time, then you increase the number and the quality of available options. You’re also more likely to get the market value.

With this in mind, if your business has a strong management team in place, you might consider a management buy-out. Conversely, if your departure will leave a skills-gap within the company, then it’s worth thinking about a management buy-in.

Perhaps you see an opportunity to provide on-going mentoring and support as either a consultant or as the company’s chairman, with a new CEO in place to handle daily operations. These options require longer-term planning but do provide a smooth transition and the possibility of some continued involvement if you want it.

Alternatively, perhaps you’d like to sell some shares to an investor and continue to draw dividends. This is a good compromise if you’d like a smaller lump sum upfront with the prospect of a regular income as the company continues to grow. If, however, time is of the essence, then liquidating the business and selling off all the assets could be an option. But the company name, employee security and prospects for future income will all vanish.

What questions should I be asking to discover my ideal business exit strategy?

Decisions like this are not easy to take without some thought and consideration. Indeed, many business owners struggle with their business exit strategy precisely because they are unsure exactly what questions they should be asking themselves. Whichever option you pick, it should be based on an understanding of how much your business is worth and how much time you want to leave for your departure.

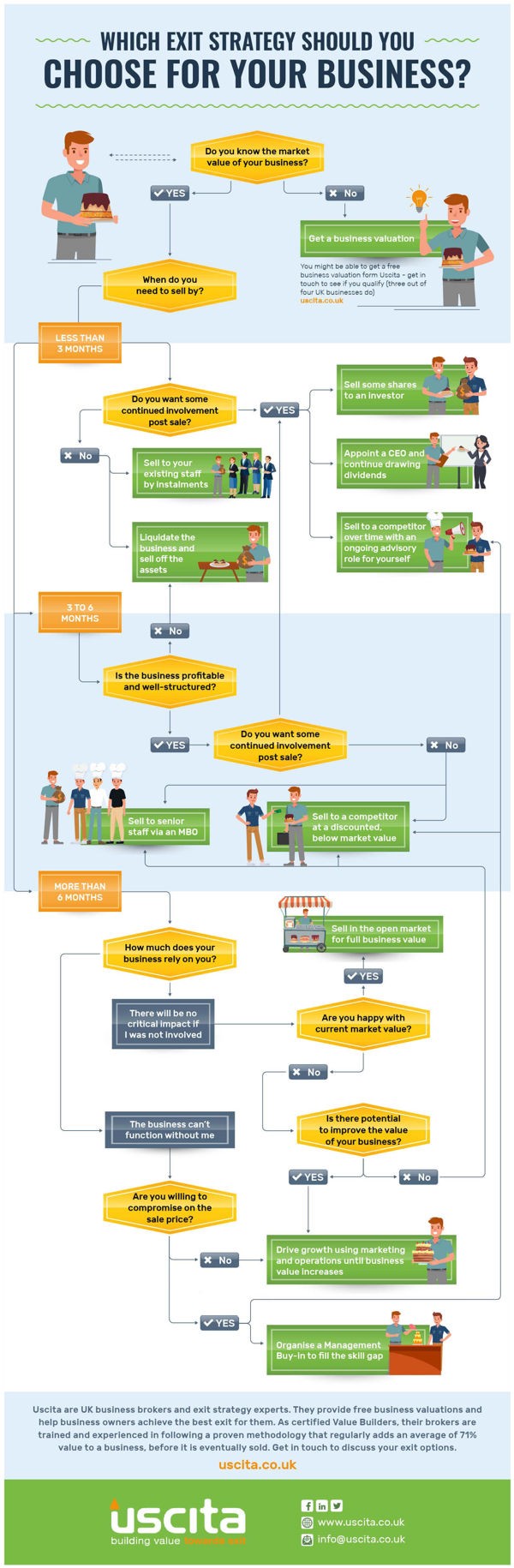

With a wide range of options on the table, choosing the best business exit strategy for your company may feel like quite a challenge. Uscita, a team of business exit experts, have created a process chart to help you through this often complex decision-making process. Answer the simple yes-or-no questions below to find out the right business exit strategy for you.

Your style is very unique in comparison to other people I have read stuff from.

Many thanks for posting when you have the opportunity, Guess I will just bookmark this blog.